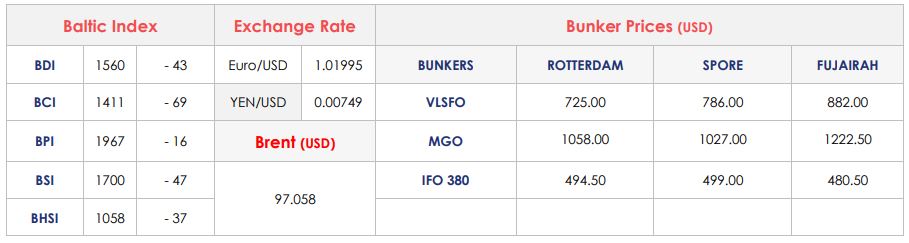

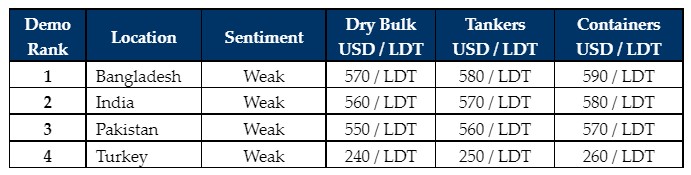

The lack of vintage tonnage appears to be the main trend in the ship recycling market these days. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “as we have now entered the month of August, the holiday season is now in full swing with Owners, Brokers and Industry stakeholders taking some time away from the shipping markets. Meaning activity remains extremely limited, with only one or two Owners dipping their toes into the market, with what has been mainly older Tanker storage units such as FSU/FPSO’s. These have been reported proceeding to India as these Owners seek HKC compliant recycling and this will remain a wise move going forward for sellers as the Indian market remains the only stable market, despite the heavy Monsoon rains which naturally affect sentiment and productivity at this time of year. Its neighbours, Bangladesh, continue to struggle with opening Letters of Credit on units above USD 3.0 mill (amended from USD 5.0 mill last week) as the country’s central Bank remains starved of US dollars. Therefore, demand has completely fallen away and ultimately looks set to reduce prices further, but until we see a unit sold into the Chattogram recycling destination, it is very hard to determine where prices lie with little sales activity to report on”.

Source: Clarkson Platou (Hellas) ltd

In a separate note Allied Shipbroking added that “the ship recycling market is on an uninspiring trajectory for some time now, given both the stringer availability of demo candidates, as well as, the decreasing mode in terms of offered scrap price levels. In the separate demo destinations and more specifically that of Bangladesh, things continued moving on a strict bearish trajectory. The tighter availability of US$ in the country has resulted to tighter L/C levels, which means an inability to compete for the larger LDT units. In Pakistan, things are currently moving on a similar pattern as well.

Source: Allied Shipbroking

Finally, in India, despite the current unrestricted L/C state of the market, local recyclers prevail more conservative at this point, given the excess volatility in terms of local steel prices. In other scrap destination, the scene in Turkey appears to also be negative and under pressure”.

Meanwhile, GMS , the world’s leading cash buyer of ships said that “sub-continent markets are going to be (seemingly) deprived of tonnage in the foreseeable future, as recycling rates continue their downward descent and tighter restrictions are placed on importing large LDT tonnage into Bangladesh and now Pakistan (with limits on large US$ value L/Cs). Firm chartering freight rates across the board are also seeing Ship Owners preferring to maintain their vessels for further voyages, rather than deal with the ongoing headaches associated with present day sub-continent recycling (despite seeing some of the firmest recycling rates in a while), all the challenges currently associated with questionable performances and a shortage of local funds to have L/Cs open in a timely manner.

Source: GMS,Inc

Any vessel(s) already in Cash Buyer hands are now threatened with unworkable levels and delivery terms from various markets and it now seems that almost every ship sold for recycling will have to turn to trading markets as an alternative, so lifeless is the ship-recycling industry at present. It is also a traditionally quieter period being summer / monsoon season / holiday period, not only in the sub-continent markets that are beset with torrential monsoon rains and see most yards slowdown as labourers return to their home towns, but it’s also the time of year when Ship Owners and Brokers head out on holidays (particularly after missing out for the last few years due to Covid). On the far end, the Turkish market continues to stagnate through its predicament, with no noteworthy change to report this week and slightly lower levels from last. As such, with dire fundamentals and little to no firm tonnage available in the market to work on, it seems set to be an extremely bleak few weeks / month(s) – perhaps even until the end of the year, whilst recycling markets get a chance to reset & stabilize and allow larger value transactions before the next cycle of ship recycling starts again”, GMS concluded.

Source: hellenicshippingnews.com

.png)